How To Subtract Gst From Total

You can type either value into. Calculating GST has never been easier on our handy NZ GST Calculator.

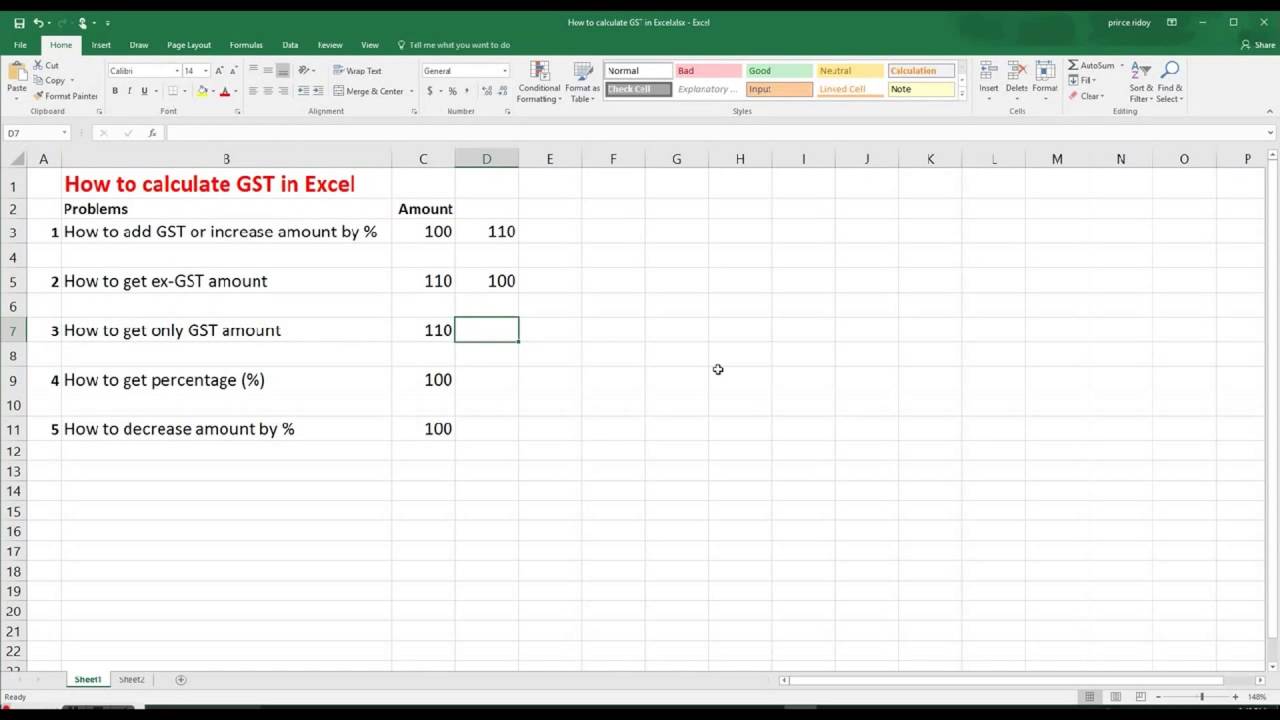

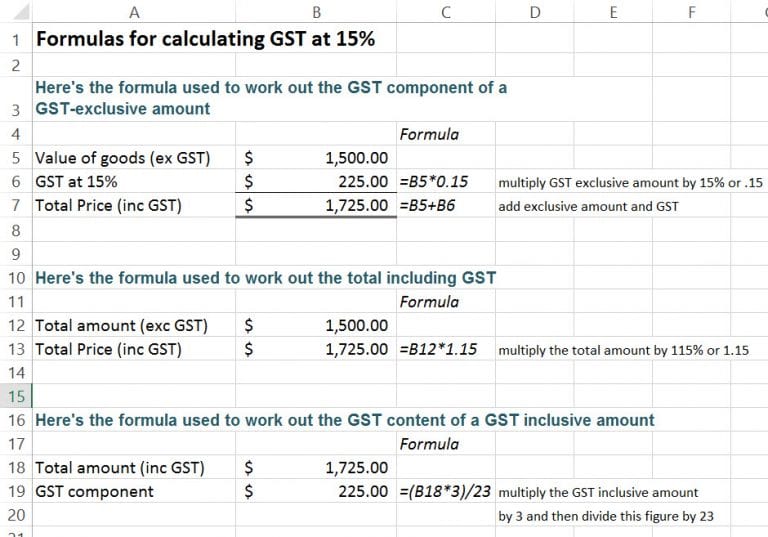

Best Excel Tutorial How To Calculate Gst

Current HST GST and PST rates table of 2021.

How to subtract gst from total. For example when a customer wants to know if a company has. Enter the original amount Step 3. Write the total amount on a blank piece of paper.

Your purchase was made within 60 days before leaving Australia. In this example sales tax is 10000 minus 9259 or 741. Type a minus sign -.

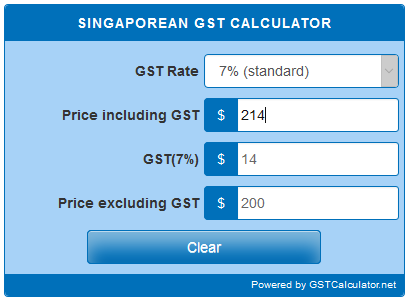

Underneath it write down the total amount of GST charged. Goods and Services Tax Australia On this website you can calculate the GST on a certain amount. New Zealand GST Calculator.

Claiming GST as an international traveller. Subtract the GST from the total amount and the resulting figure is the amount with the GST taken out of it. Then subtract that from 1700 to get the amount of GST you paid.

Select GST InclusiveGST Exclusive as per the requirement Step 2. Calculating the GST amount can be useful in many situations. Calculation of GST part in this case is more complicated gst final_price 5 105 final_price 21.

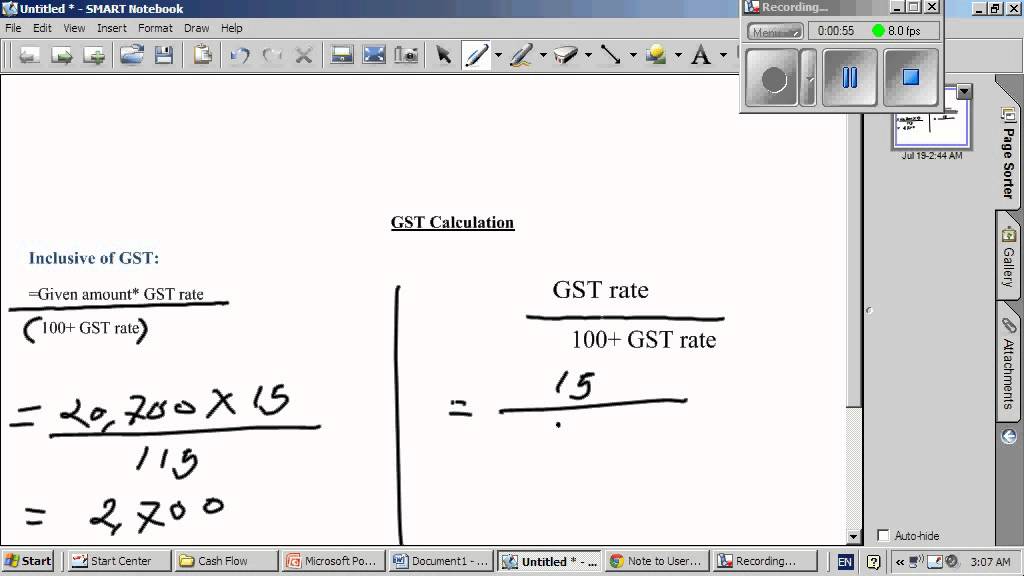

Working backwards to find the GST and GST exclusive amounts from the total GST inclusive price. Paying two-monthly is the most popular method in New Zealand. Divide the bill for the goods or services by one plus the GST.

This gives you the pre-tax price of the item. The total amount of goods Total value of goods GST amount. 200 10 220 however 220 - 10 is NOT equal 200 actually its 198.

How much is GST in New Zealand. 115 X 3 23 15 GST. Base_amount final_price 105.

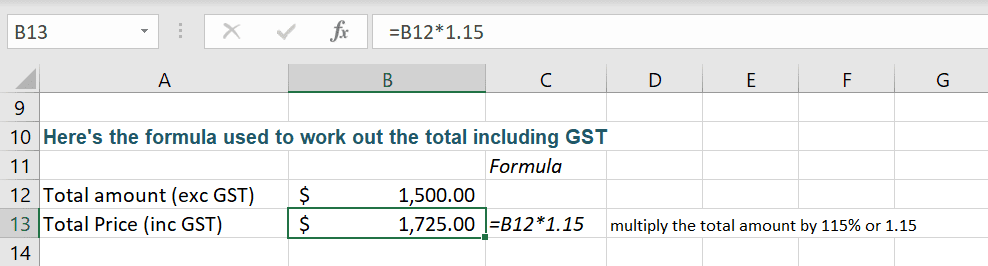

To do this you simply multiply the value excluding GST by 15 or by 015. You can choose whether to submit and pay GST monthly two-monthly or six-monthly - it depends on your business size and personal situation - see the IRD website for more details. To find the total including GST simply add the two values together.

63 - 60 3. Inland Revenue IRD recommends the following formula to find the GST amount from a GST inclusive price. Even on separate.

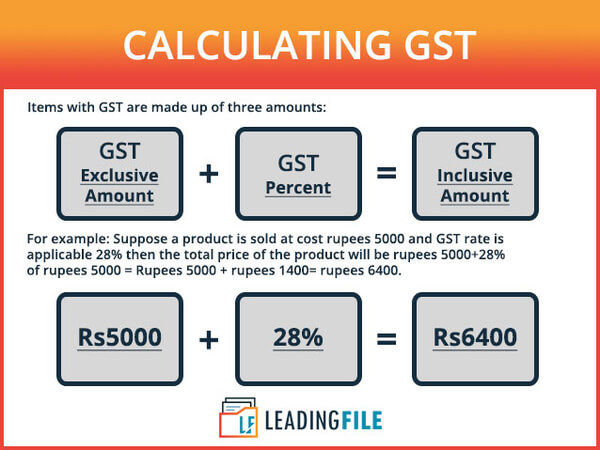

GST Amount 2000x 12100Rs. As mentioned above it is currently 15. GST Inclusive Price X 3 23 GST Amount.

Its reference will be added to the formula automatically A2. GST Amount Value of supply Value of supply x 100 100GST Consider that the total cost of the procurement of goods is 2000 and the GST tax rate is 12. Subtract the Tax Paid From the Total Subtract the amount of tax you paid from the total post-tax price of the item.

In the cell where you want to output the difference type the equals sign to begin your formula. It is a fact that many people have trouble calculating the GST amount. In the example if your bill including GST was 229 then 229 divided by 105 equals 21810.

Quickly find 15 GST amount for any price or work backwards to get the original GST-exclusive price if you only have the GST-inclusive one. To figure out how much GST was included in the price you have to divide the price by 11 2201120. The GST is the difference between this and the aftertax total.

Easy and Simple to use. That means the total sales for hot food -- not including sales tax -- is 10000 divided by 108 or 9259. You can see that to find the total before GST all you need to do is divide by 105.

GST returns and payments due for the taxable period ending the prior December. Do that for 1700 and you have your subtotal. To work out the price without GST you have to divide the amount by 11 22011200 Avoid most common GST calculation mistake when using percentages.

Mentioned below are steps to be followed for calculating GST through GST Calculation Tool. On March 23 2017 the Saskatchewan PST as raised from 5 to 6. Adds or Subtracts GST at 15 or older 125.

Subtract your bill without GST from Step 2 from the bill for the goods or services with the GST to find the GST. So if you paid 2675 in total for two books and you know from looking at the receipt that 175 of. Final_price 100 GST 100 21 476 and base_amount 100 105 9524.

1 October 2010 - Present. Select the GST rate from the drop down menu list Step 4. Your purchases are from a single business with the same Australian Business Number ABN and total AU300 GST inclusive or more.

GST Due Dates. If the GST is included in the value of supply. You have the original tax invoice for.

Click on the cell containing a minuend a number from which another number is to be subtracted. This is your bill without GST. Subtract the total receipts from the ending figure from step 3 to calculate the amount of tax owed on the department receipts.

In the example below B5 has been multiplied by 015 which is the same as 15. For example if your total amount was 112 of which 5 was GST you will be left with 107 when you take the GST out of the amount. See the articleTax rate for all canadian remain the same as in 2017.

How To Calculate Gst At 15 Using Excel Formulas Excel At Work

How To Calculate Gst At 15 Using Excel Formulas Excel At Work

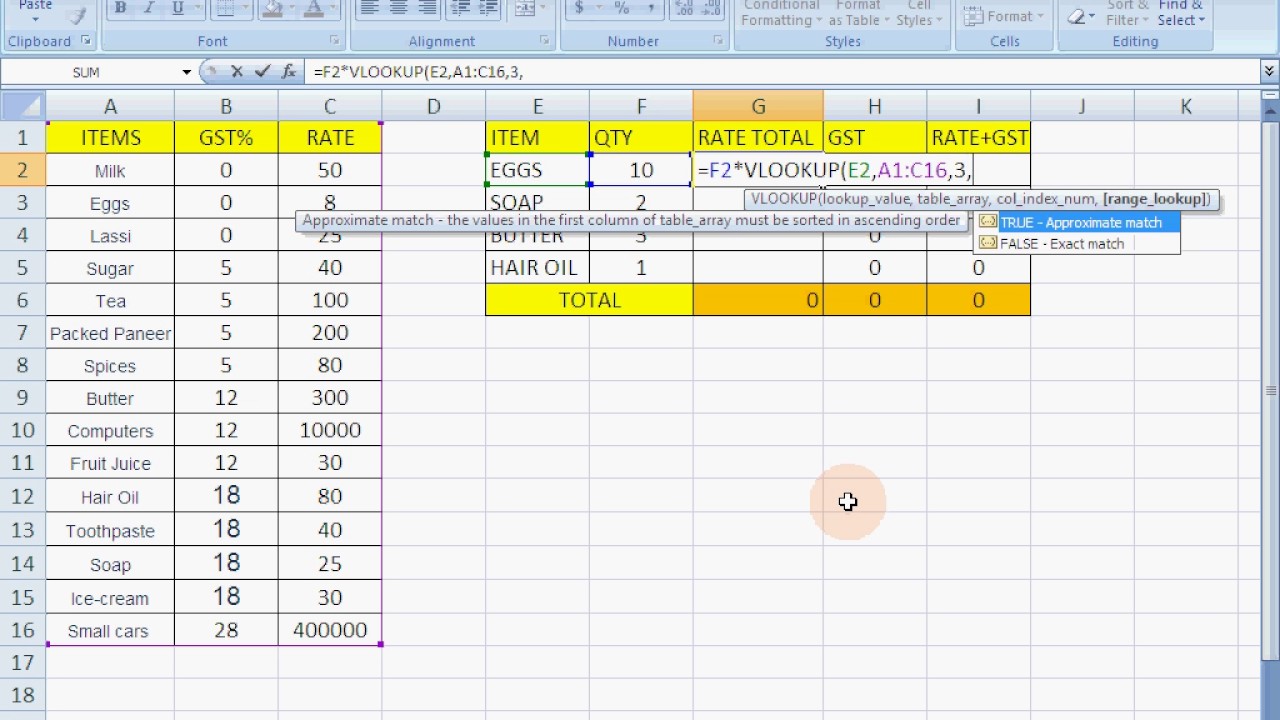

How To Calculate Vat In Excel Vat Formula Calculating Tax In Excel

Formulas To Include Or Exclude Tax Excel Exercise

How To Calculate Gst In Excel By Using Different Techniques With Easy Step By Step Tutorial Youtube

If The Total Amount Is Rs 2065 Including The Gst 18 Then What Is The Actual Price Quora

How To Calculate Gst At 15 Using Excel Formulas Excel At Work

Top 5 Ways To Use Percentages In Excel Trainers Direct Computer Courses Sydney Corporate Training

How To Calculate Gst At 15 Using Excel Formulas Excel At Work

How To Make Calculating Gst Easier

How To Calculate Gst Or Income Tax In Excel

Singaporean Gst Calculator Gstcalculator Net

How To Calculate The Gst In Australia Video Lesson Transcript Study Com

How To Calculate Gst Percentage In Excel How To Wiki 89

How To Correctly Calculate Gst Figures Kiwitax

How To Calculate Gst In Excel Vafasr

How To Calculate Gst Amount Online With Formula Gst Calculator

How To Calculate The Taxes Gst Pst And The Final Price Youtube